Property

Schools are taxpayer investments that must be protected against damage or loss. Proper risk management requires a combination of property coverages to ensure protection from the most common exposures. It is important to consider that many coverage forms may exclude or sub-limit coverage for certain exposures. You should review and compare all coverages, limits and deductibles with your insurance broker to ensure you make the best purchase decision.

Storms significant enough to be named or numbered have the potential for catastrophic damage to public entities – particularly in coastal areas.

Storms significant enough to be named or numbered have the potential for catastrophic damage to public entities – particularly in coastal areas.

The level of exposure requires specialized coverage from carriers who have the capacity and experience in coastal named-storm property coverage. The potential for property damage inherent in NSW events often cause carriers to reduce their exposure by providing specific limits, deductibles and exclusions separate from other property coverages.

Named-Storm Wind deductibles are usually expressed as a percentage and are normally applied on either a per-schedule, per-location, or per-building basis. Your financial exposure can vary greatly depending on the coverages/limits/deductibles you select.

Key NSW Issues to Compare:

- Limits

- Deductibles

- Percentage or fixed amount – annual aggregate minimums and maximums

- Deductible Percentage

- Per Schedule

- Per Location

- Per Building

- Sub-limits due to roof age

- Sub-limits for outdoor or other types of property

- Exclusions for wind-driven rain

- Flood may not be included or may need to be supplemented

Wind and Hail not generated by a named or numbered storm present a significant yet lesser exposure than named-storms.

Wind and Hail not generated by a named or numbered storm present a significant yet lesser exposure than named-storms.

Like Named Storm Wind Coverage, Wind and Hail Coverage may have separate limits and deductibles from other property coverages and may have exclusions or sublimits requiring review and comparison with your broker.

The unique exposures of storms require specialized coverage forms. More common exposures like fire, theft and vandalism are typically covered under All Other Perils (AOP) coverage.

The unique exposures of storms require specialized coverage forms. More common exposures like fire, theft and vandalism are typically covered under All Other Perils (AOP) coverage.

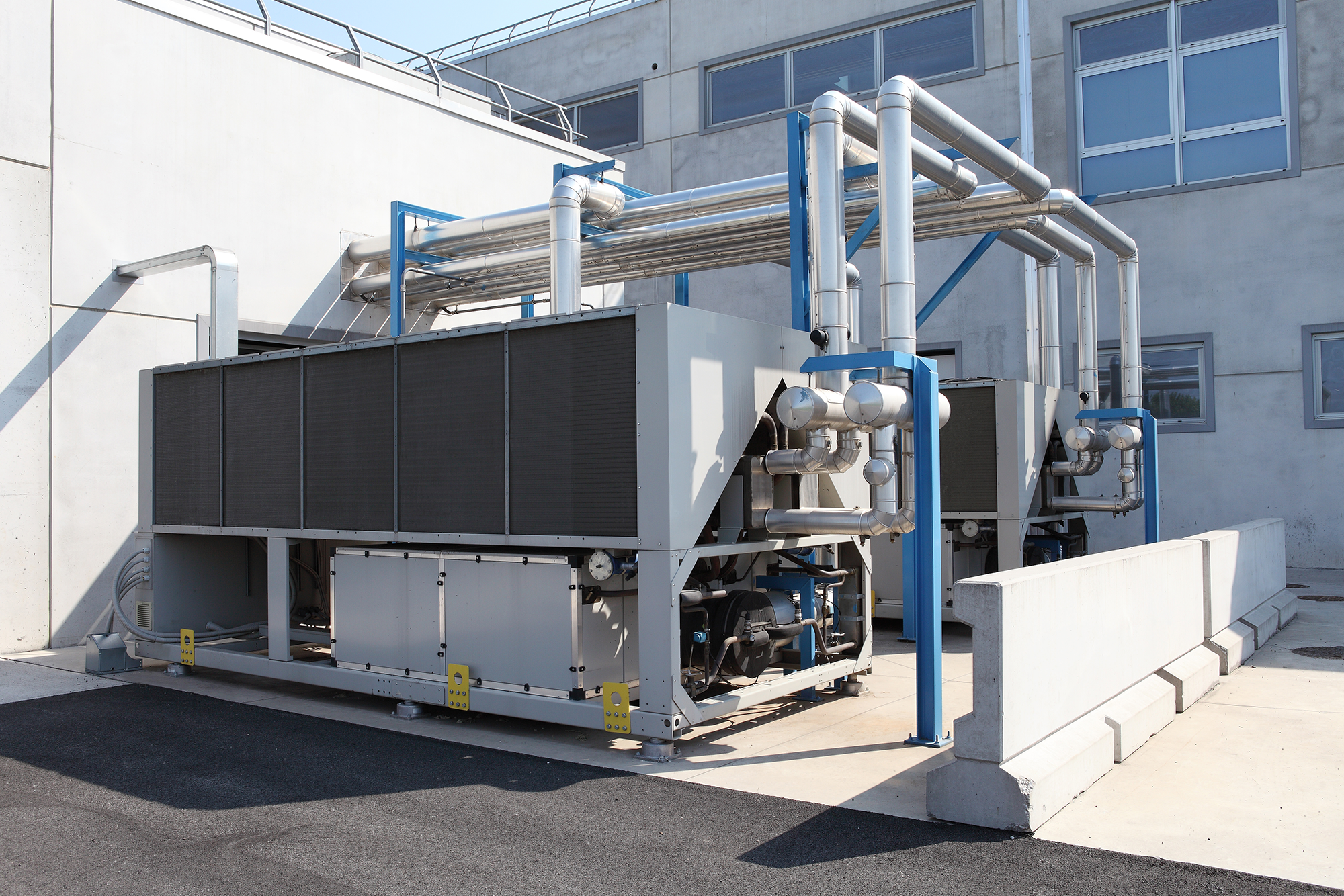

Most property coverage applies to the building structure and its contents. However, Equipment Breakdown, also known as “Boiler and Machinery” provides coverage for damage to building infrastructure items such as:

Most property coverage applies to the building structure and its contents. However, Equipment Breakdown, also known as “Boiler and Machinery” provides coverage for damage to building infrastructure items such as:

- Air Conditioning and Refrigeration

- Electrical Equipment

- Computers and Telecommunications

- Business Equipment

- Production Machinery

- Computer-Controlled Machines

- Security Systems

- Retail “Point-of-Sale” Systems

- Ventilation Systems

- Generators

- Elevators and Escalators

- Boilers

- Hot Water Heaters

- Motors and Pumps

- Engines

Computer systems and networks have become an indispensable component of doing business. Computer hardware, software, data and media can represent millions in taxpayer investment. EDP coverage is also sometimes known as Computer Coverage and Data Processing Coverage. It can be written by itself or added to a property or package policy via a separate form or endorsement.

Computer systems and networks have become an indispensable component of doing business. Computer hardware, software, data and media can represent millions in taxpayer investment. EDP coverage is also sometimes known as Computer Coverage and Data Processing Coverage. It can be written by itself or added to a property or package policy via a separate form or endorsement.

EDP policies vary widely. Your broker can help answer the following questions to help find the best coverage fit.

- What types of equipment and accessories are covered by the policy?

- What perils are covered? Which ones are excluded?

- How is the value damaged property calculated?

- Does the policy cover loss of income and extra expense?

- What additional coverages are included?

Mobile property is often excluded from standard property coverage forms and public entities can benefit by obtaining Inland Marine coverage which provides insurance for property in transit over land, certain types of moveable property, instrumentalities of transportation (such as bridges, roads, and piers, instrumentalities of communication (such as television and radio towers). Many inland marine coverage forms provide coverage without regard to the location of the covered property; these are sometimes called “floater” policies. As a group, inland marine coverage forms are generally broader than property coverage forms often with lower deductibles than the Wind or AOP property coverages. Public Entities typically obtain Inland Marine coverage for the following:

Mobile property is often excluded from standard property coverage forms and public entities can benefit by obtaining Inland Marine coverage which provides insurance for property in transit over land, certain types of moveable property, instrumentalities of transportation (such as bridges, roads, and piers, instrumentalities of communication (such as television and radio towers). Many inland marine coverage forms provide coverage without regard to the location of the covered property; these are sometimes called “floater” policies. As a group, inland marine coverage forms are generally broader than property coverage forms often with lower deductibles than the Wind or AOP property coverages. Public Entities typically obtain Inland Marine coverage for the following:

- Miscellaneous Equipment

- Mowers, Tractors, Utility Carts, etc

- Band Equipment

- Computers

- Fine Arts

- Personal Property

Crime insurance is insurance to manage the loss exposures resulting from criminal acts such as robbery, burglary and other forms of theft. It is also called “fidelity insurance”. Many businesses purchase crime insurance that allows them to file claims for employee theft or other offenses with the potential to cause financial ruin.

Crime insurance is insurance to manage the loss exposures resulting from criminal acts such as robbery, burglary and other forms of theft. It is also called “fidelity insurance”. Many businesses purchase crime insurance that allows them to file claims for employee theft or other offenses with the potential to cause financial ruin.

Briefly described, commercial crime insurance covers money, securities and other property against a variety of criminal acts, such as employee theft, robbery, forgery, extortion and computer fraud.

Typically, commercial Crime Coverage forms include the following coverages:

- Employee Theft

- Forgery or Alteration

- Inside the Premises – Theft of Money and Securities

- Inside the Premises – Robbery or Safe Burglary of Other Property

- Outside the Premises

- Computer Fraud

- Funds Transfer Fraud

- Money Orders and Counterfeit Money

Flood insurance typically provides coverage for damage caused by rising water. This means that other sources of water damage such as wind-driven rain or water pipe failure may be excluded.

Flood insurance typically provides coverage for damage caused by rising water. This means that other sources of water damage such as wind-driven rain or water pipe failure may be excluded.

Depending on the type of exposure – Wind, Hail, Named-Storm, coverage for water damage caused by factors other than rising water may be provided under other property coverage forms. It is important to review all Flood and property forms to insure coverage for the most common types of water damage.

Public entities with multiple locations may have properties in different FEMA Flood zones possibly requiring multiple specialized polices to ensure adequate coverage.

Builder’s risk insurance is a special type of property insurance which provides coverage for damage to buildings while they are under construction. Builder’s risk insurance is coverage that protects the entities insurable interest in materials, fixtures and/or equipment being used in the construction or renovation of a building or structure should those items sustain physical loss or damage from a covered cause.

Builder’s risk insurance is a special type of property insurance which provides coverage for damage to buildings while they are under construction. Builder’s risk insurance is coverage that protects the entities insurable interest in materials, fixtures and/or equipment being used in the construction or renovation of a building or structure should those items sustain physical loss or damage from a covered cause.

Builder’s risk typically covers perils such as fire, wind, theft and vandalism and many more. It typically does not cover perils such as flood or wind in coastal zones unless the policy has been specifically endorsed to do so. These policies also do not cover accidents and injuries at the workplace and is intended to terminate when the work has been completed and the property is ready for use or occupancy.

Builder’s Risk is often purchased by the general contractor and included in the construction project costs but should be reviewed by your broker to ensure adequate coverage and seamless transition to your property coverage upon completion of the project.

Terrorism insurance is insurance purchased by property owners to cover their potential losses and liabilities that might occur due to terrorist activities.

Terrorism insurance is insurance purchased by property owners to cover their potential losses and liabilities that might occur due to terrorist activities.

In 2002, the US Congress enacted the Terrorism Risk Insurance Act, in which the government shared the cost of large insurance losses. In 2015, the US Congress reauthorized the original Terrorism Risk Insurance Act (TRIA) into the Terrorism Risk Insurance Program Reauthorization Act of 2015 (TRIPRA 2015).

TRIPRA 2015 requires certain criteria to have been met before federal coverage under the program begins. First, P&C insurance losses resulting from a terrorism-linked attack must meet the minimum damage certification level of USD 5 million. If losses are expected to meet this minimum threshold, then the event must also be officially certified as an “act of terrorism.” This certification is determined by the U.S. Secretary of the Treasury in concurrence with the Attorney General of the United States and—new under TRIPRA 2015—the U.S. Secretary of Homeland Security.

Intended as a backstop for major terrorism events, TRIPRA may not be considered sufficiently responsive at the local level. Many carriers now provide terrorism insurance with broader coverage and lower deductibles than TRIPRA.

Find Out More About Our Services and Capabilities

We are here to answer any questions you may have and look forward to hearing from you.