Construction Material Price Increases

Volatility is synonymous with risk, and rising material prices are dominating the conversations in the construction industry right now.

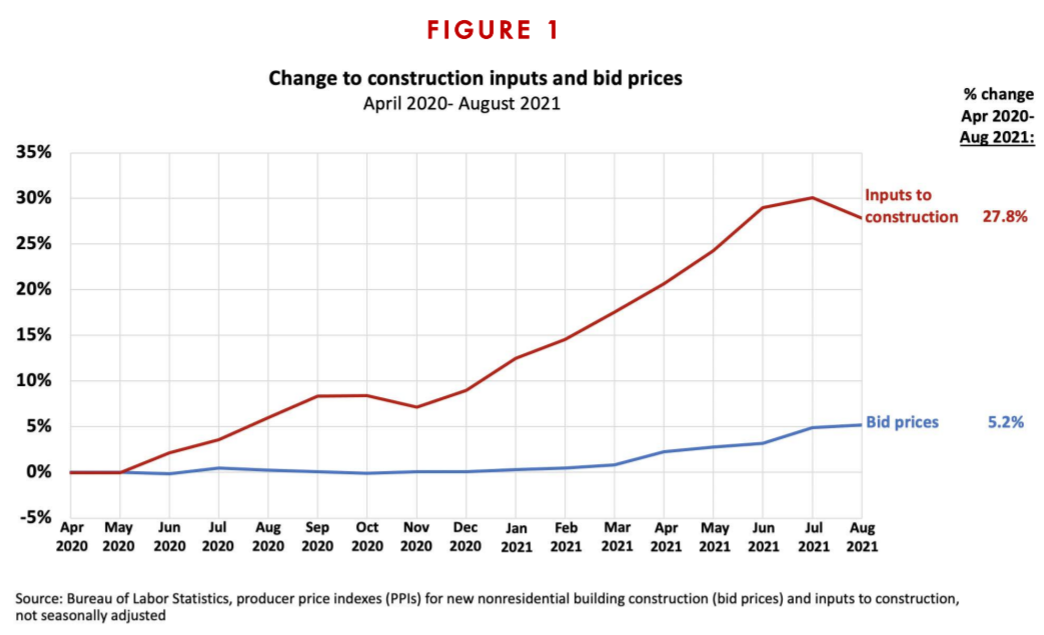

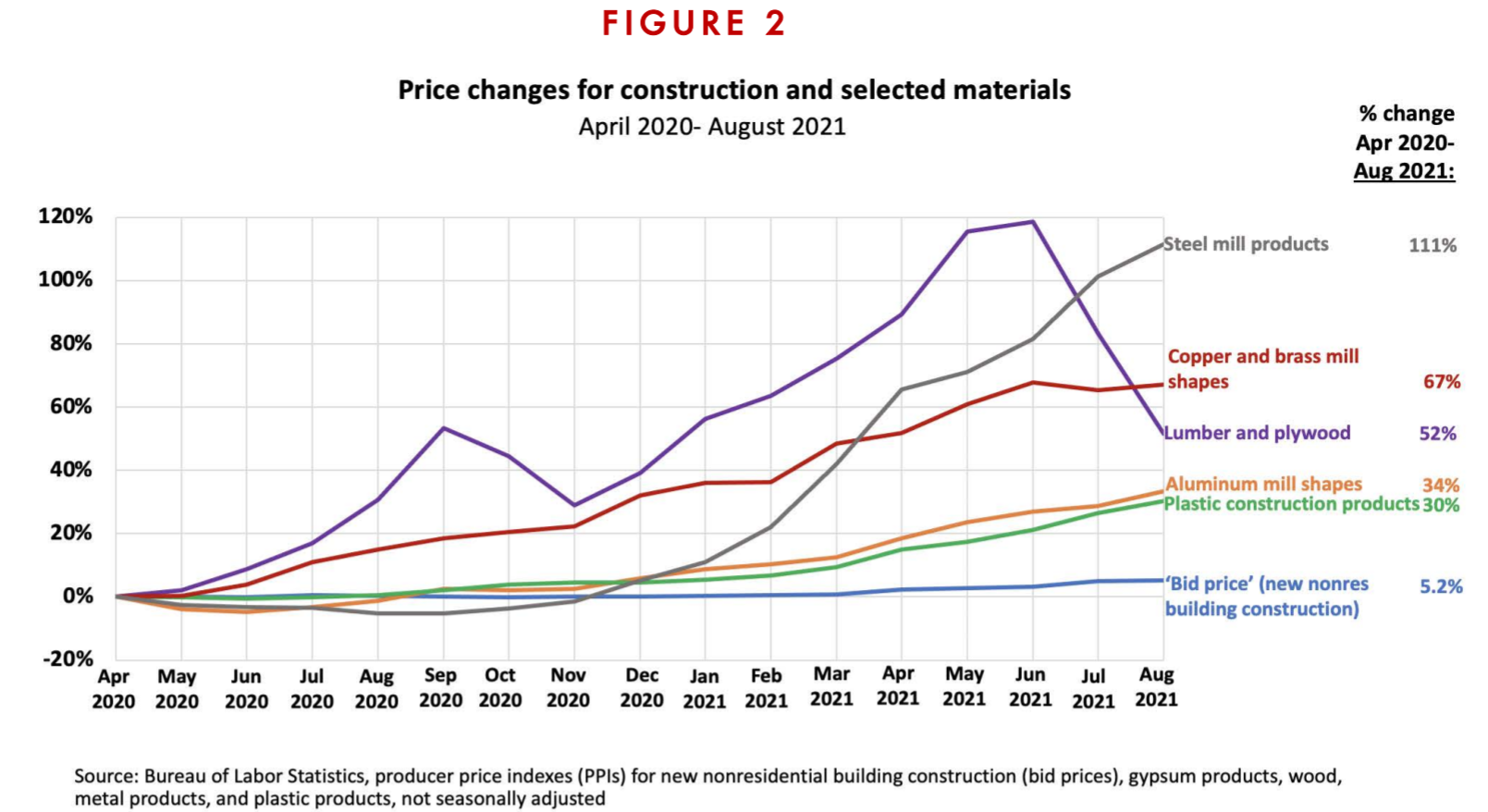

Material costs have grown by 27.8% since May 2020, according to the AGC Construction Inflation Alert, but bid prices have only accounted for 5.2% of the increase. Lumber, for example, saw a 120% rise in a year and then settled at 52%. Steel mill products have risen by more than 111% in a short period of time, and it appears to be still climbing.

So, who bears the risk? Most GC’s, trades and material suppliers operate on narrow margins where increases like these could be detrimental to the industry. In this current reality, how do we manage through these times and remain profitable?

At the Arizona Builders Alliance Conference, Mike Holden, an attorney with Holden Willits gave some great advice to the construction industry on how to manage this risk:

- Read the fine print in the price quotes from your suppliers to know how long the price quotes are guaranteed

- Talk to the upchain party to discuss the risk whether they be an owner to a GC or a contractor to a material supplier

- Include an allowance in your bids to provide additional funds for potential increases

- Buy materials early to allow you to capture the price before it increases, but don’t forget to review your installation floater for proper insurance coverage

Holden also recommends contractors use the Consensus Docs form 100.1 Amendment No. 01. For those not familiar with Consensus Docs, it is an alternative to the AIA contract that was created with a consortium of construction parties and endorsed by the ABC and AGC. The Amendment No. 01 is an agreement with the owner so that “each party is entitled to an equitable adjustment for an increase or decrease in this baseline price subject to timely notice.”

Ron Wilson from Mortenson added that “it is time to loosen our grip on lean” because the Just-In-Time deliveries and processes don’t leave the project with any margin of error in delays, shipments or availability of skilled labor.

Storms draw something out of us that calm seas don’t. We’re in a storm of price fluctuations right now in our industry. The good news is that the construction economic indicators show significant growth, but to earn the profits along the way, contractors need to manage the material cost risk today.

About the Author

Share This Story

Related Blogs

OSHA’s Safe and Sound Week Scheduled for Aug. 12-18

Each year, more than 5,000 workers are killed on the job. Additionally, more than 3.6 million employees are seriously injured each year while at work. Because of this, the Occupational Safety and Health Administration (OSHA) holds a nationwide event each August called Safe and Sound Week, which promotes the importance of companies incorporating safety and health programs into their workplace. This year, the event runs Aug. 12-18, 2024.

2024 Midyear Market Outlook: Workers’ Compensation

Profitable underwriting results have generated favorable conditions across the workers’ compensation insurance market for nearly a decade. According to the National Council on Compensation Insurance (NCCI), the segment produced combined ratios of 84.5 and 84.9 in 2022 and 2023, respectively, demonstrating continued profitability.

CrowdStrike, the Most Important Cyber Accumulation Loss Event Since NotPetya, Highlights Single Points of Failure

In what is being called “the most important cyber accumulation loss event since NotPetya,” the July 19, 2024, global technology outage (CrowdStrike) will produce scores of insurance claims across a range of policies, test cyber policy wordings,and sharpen the industry’s focus on single points of failure.