FEMA Flood Risk Rating Changes

Atlantic hurricane season is underway, but it doesn’t take a hurricane to cause a flood event. Flooding tops the list as the most common natural disaster in the United States and can happen anywhere. The aftermath of a flood event can be devastating emotionally and financially. The Federal Emergency Management Agency (FEMA) says just one inch of water in a structure can cause up to $25,000 of damage.

Even if your home or business isn’t near a flood zone, securing an adequate flood insurance policy could be a lifesaver when dealing with a natural disaster. FEMA is launching a program this fall that could change how homeowners pay for their flood insurance policies.

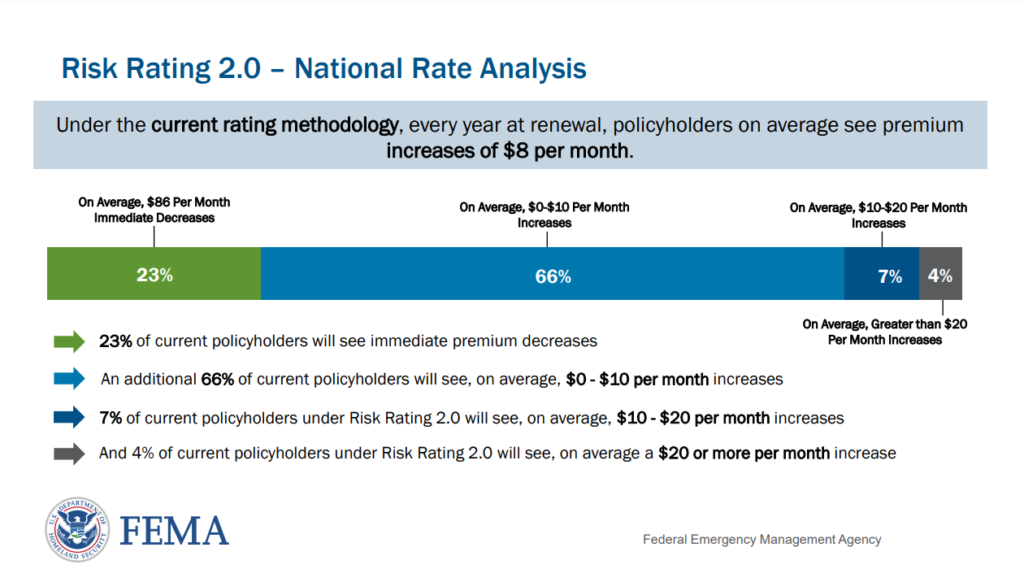

FEMA will roll out a new rating system for the National Flood Insurance Program (NFIP), Risk Rating 2.0.

According to FEMA, Risk Rating 2.0 allows the agency to better inform individuals and communities about flood risk, set premiums to signal those risks, and promote actions to mitigate against them. Individuals will no longer pay more than their fair share in flood insurance premiums.

Here’s what you need to know about Risk Rating 2.0:

- In Phase I: New policies beginning Oct. 1, 2021, will be subject to the Risk Rating 2.0 rating method. Also, beginning Oct. 1, existing policyholders eligible for renewal will take advantage of immediate decreases in their premiums.

- In Phase II: All policies renewing on or after April 1, 2022, will be subject to the Risk Rating 2.0 rating method.

Conclusion

The NFIP’s current rating methodology has not changed since the 1970s and does not consider individual flood risk and underlying home values. Risk Rating 2.0 will change the way FEMA views flood risk and prices flood insurance.

FEMA continues to engage with Congress, its industry partners and state, local, tribal and territorial agencies to ensure clear understanding of these changes.

It’s critical to work with industry experts who have the necessary knowledge and experience.

Contact a team member near you at INSURICA.com/our-team to learn more about flood insurance or assist you with your current policy.

About the Author

Share This Story

Related Blogs

OSHA’s Safe and Sound Week Scheduled for Aug. 12-18

Each year, more than 5,000 workers are killed on the job. Additionally, more than 3.6 million employees are seriously injured each year while at work. Because of this, the Occupational Safety and Health Administration (OSHA) holds a nationwide event each August called Safe and Sound Week, which promotes the importance of companies incorporating safety and health programs into their workplace. This year, the event runs Aug. 12-18, 2024.

2024 Midyear Market Outlook: Workers’ Compensation

Profitable underwriting results have generated favorable conditions across the workers’ compensation insurance market for nearly a decade. According to the National Council on Compensation Insurance (NCCI), the segment produced combined ratios of 84.5 and 84.9 in 2022 and 2023, respectively, demonstrating continued profitability.

CrowdStrike, the Most Important Cyber Accumulation Loss Event Since NotPetya, Highlights Single Points of Failure

In what is being called “the most important cyber accumulation loss event since NotPetya,” the July 19, 2024, global technology outage (CrowdStrike) will produce scores of insurance claims across a range of policies, test cyber policy wordings,and sharpen the industry’s focus on single points of failure.