When purchasing any product or service, it makes perfect sense to associate a better RATE with a better PRICE.

Consider these simple everyday examples:

- When purchasing a house, an interest rate of 3.5% will result in a lower mortgage payment than a rate higher than 3.5%.

- When buying general liability insurance, auto insurance, or home insurance, a lower rate will equate to a lower annual premium.

- When purchasing goods or materials, a business will pay less on a “low” rate, rather than a “high” rate.

- When gasoline is $3.99 per gallon, it costs less to fill the tank than when it’s $4.50 per gallon.

It is common for a business owner or CFO to use the words “rate” and “price” (annual premium) interchangeably. With Workers’ Compensation, this logic does not work. The pricing components used to calculate Workers’ Compensation premiums do not follow the general rule that lower rates = lower price.

The exact dollar for dollar mechanisms are better explained in a 43 page manual which dissects the NCCI (National Council on Compensation Insurance) E-Mod promulgation, but to keep it simple, consider first how Workers’ Compensation annual premiums are calculated in the first place:

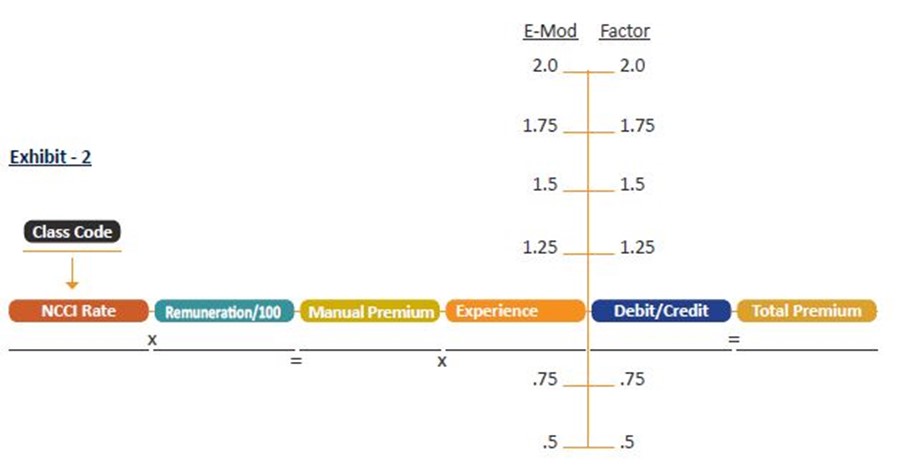

- Each worker has a class code assigned to them, based on what duties they perform. There are over 1,000 class codes.

- Each class code has a rate, and that rate is set by the NCCI each year, and every work comp carrier / agent / payroll service, etc. MUST use the rate established for that class code, period.

- The total payroll for each class code is multiplied by the rate, and that gives the “Manual Premium” – which would be the actual premium, if there were no E-Mod score.

- But, there is an E-Mod score.

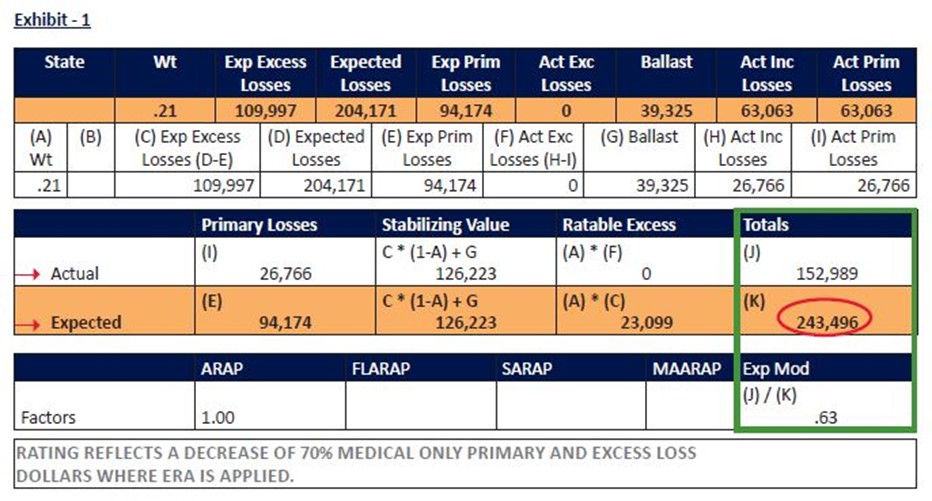

- The E-Mod score itself is a multiplier; A product of the Actual Losses divided into the NCCI “Excepted Losses” (*see contents within green box in Exhibit 1)

- The annual work comp premium that any business pays is the “manual premium” (class code / rate X payroll) multiplied also by the E-mod score.

- When the NCCI lowers workers’ compensation rates, this directly and proportionally also decreases the “Expected Losses” – which you can see is the numerator in the equation (in Exhibit 1, is 243,496).

- We all remember, from elementary math, that when the denominator decreases, and the numerator (152,989) remains the same (which it will, because the numerator is “actual losses” – meaning, losses that have actually occurred), the product will go UP.

Workers’ Compensation: How the Real Price is Calculated:

Simplification on how annual WC premiums are calculated can be explained with a simple and separate multiplication example:

Exhibit – 3

- A) 7 x 10 x 3 x 4 = 840

- B) 10 x 3 x 4 x 7 = 840

Note: no matter how one arranges the 7, the 10, the 4, and the 3 – when multiplied together, they will equal 840, every single time. There is nothing to argue about here. Workers’ Compensation premium calculations work similarly; no matter how you arrange or shift the numbers, when you multiply

them together, the sum product is the same.

In the examples I used to kick off this article (mortgage, insurance, materials, and gasoline) – note that an E-Mod score is not applied as a multiplier in any of those examples. Workers Compensation is the only thing in life you will purchase that uses an E-Mod score as a multiplier. Therefore, it’s important to be aware of the multiple factors that go in to the calculation of Workers Compensation annual premiums.

Class Code

With Workers’ Compensation ONLY, one would be correct in saying the E-Mod score determines the majority of their annual premium, not the NCCI assigned (non-disputable) rates assigned to each class code.

“Lower rates should equal a lower premium, right?”

Wrong. It’s just math.

For questions or more information on this topic contact one of your local INSURICA Construction Team Members.

This is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice.

About the Author

Share This Story

Related Blogs

OSHA’s Safe and Sound Week Scheduled for Aug. 12-18

Each year, more than 5,000 workers are killed on the job. Additionally, more than 3.6 million employees are seriously injured each year while at work. Because of this, the Occupational Safety and Health Administration (OSHA) holds a nationwide event each August called Safe and Sound Week, which promotes the importance of companies incorporating safety and health programs into their workplace. This year, the event runs Aug. 12-18, 2024.

2024 Midyear Market Outlook: Workers’ Compensation

Profitable underwriting results have generated favorable conditions across the workers’ compensation insurance market for nearly a decade. According to the National Council on Compensation Insurance (NCCI), the segment produced combined ratios of 84.5 and 84.9 in 2022 and 2023, respectively, demonstrating continued profitability.

CrowdStrike, the Most Important Cyber Accumulation Loss Event Since NotPetya, Highlights Single Points of Failure

In what is being called “the most important cyber accumulation loss event since NotPetya,” the July 19, 2024, global technology outage (CrowdStrike) will produce scores of insurance claims across a range of policies, test cyber policy wordings,and sharpen the industry’s focus on single points of failure.