When purchasing any product or service, it makes perfect sense to associate a better RATE with a better PRICE.

Consider these simple everyday examples:

- When purchasing a house, an interest rate of 3.5% will result in a lower mortgage payment than a rate higher than 3.5%.

- When buying general liability insurance, auto insurance, or home insurance, a lower rate will equate to a lower annual premium.

- When purchasing goods or materials, a business will pay less on a “low” rate, rather than a “high” rate.

- When gasoline is $3.99 per gallon, it costs less to fill the tank than when it’s $4.50 per gallon.

It is common for a business owner or CFO to use the words “rate” and “price” (annual premium) interchangeably. With Workers’ Compensation, this logic does not work. The pricing components used to calculate Workers’ Compensation premiums do not follow the general rule that lower rates = lower price.

The exact dollar for dollar mechanisms are better explained in a 43 page manual which dissects the NCCI (National Council on Compensation Insurance) E-Mod promulgation, but to keep it simple, consider first how Workers’ Compensation annual premiums are calculated in the first place:

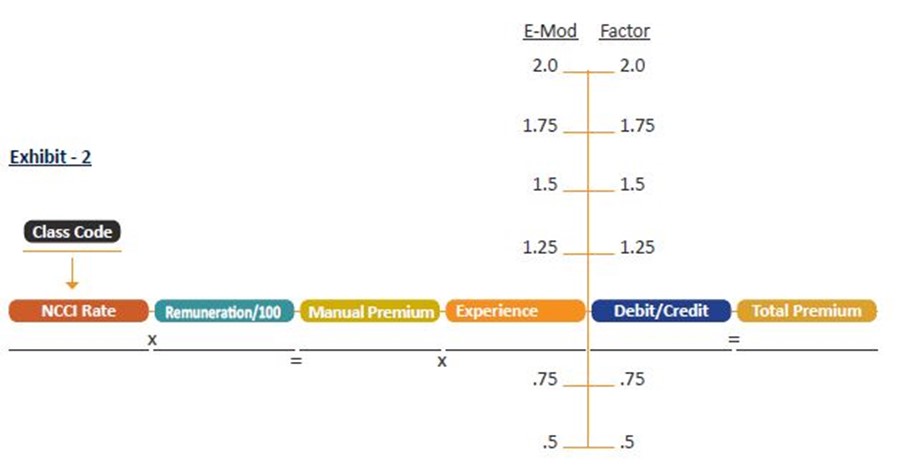

- Each worker has a class code assigned to them, based on what duties they perform. There are over 1,000 class codes.

- Each class code has a rate, and that rate is set by the NCCI each year, and every work comp carrier / agent / payroll service, etc. MUST use the rate established for that class code, period.

- The total payroll for each class code is multiplied by the rate, and that gives the “Manual Premium” – which would be the actual premium, if there were no E-Mod score.

- But, there is an E-Mod score.

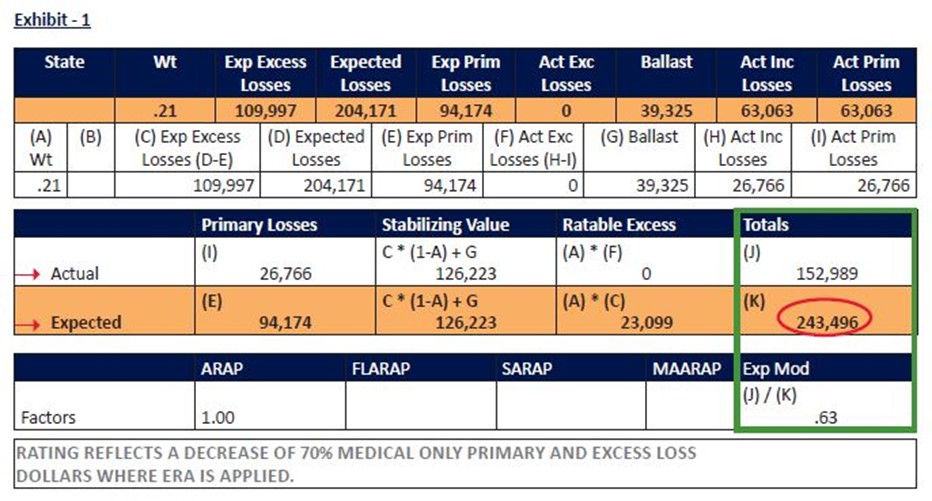

- The E-Mod score itself is a multiplier; A product of the Actual Losses divided into the NCCI “Excepted Losses” (*see contents within green box in Exhibit 1)

- The annual work comp premium that any business pays is the “manual premium” (class code / rate X payroll) multiplied also by the E-mod score.

- When the NCCI lowers workers’ compensation rates, this directly and proportionally also decreases the “Expected Losses” – which you can see is the numerator in the equation (in Exhibit 1, is 243,496).

- We all remember, from elementary math, that when the denominator decreases, and the numerator (152,989) remains the same (which it will, because the numerator is “actual losses” – meaning, losses that have actually occurred), the product will go UP.

Workers’ Compensation: How the Real Price is Calculated:

Simplification on how annual WC premiums are calculated can be explained with a simple and separate multiplication example:

Exhibit – 3

- A) 7 x 10 x 3 x 4 = 840

- B) 10 x 3 x 4 x 7 = 840

Note: no matter how one arranges the 7, the 10, the 4, and the 3 – when multiplied together, they will equal 840, every single time. There is nothing to argue about here. Workers’ Compensation premium calculations work similarly; no matter how you arrange or shift the numbers, when you multiply

them together, the sum product is the same.

In the examples I used to kick off this article (mortgage, insurance, materials, and gasoline) – note that an E-Mod score is not applied as a multiplier in any of those examples. Workers Compensation is the only thing in life you will purchase that uses an E-Mod score as a multiplier. Therefore, it’s important to be aware of the multiple factors that go in to the calculation of Workers Compensation annual premiums.

Class Code

With Workers’ Compensation ONLY, one would be correct in saying the E-Mod score determines the majority of their annual premium, not the NCCI assigned (non-disputable) rates assigned to each class code.

“Lower rates should equal a lower premium, right?”

Wrong. It’s just math.

For questions or more information on this topic contact one of your local INSURICA Construction Team Members.

This is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice.

About the Author

Share This Story

Related Blogs

OSHA Announces Top 10 Violations for 2025

OSHA recently revealed its top 10 most frequently cited standards in the 2025 fiscal year using preliminary data. This information is valuable for businesses of all kinds, as it helps them identify common exposures that affect their workforce and gives them the information they need to plan their compliance programs.

Cyber Hygiene for Schools: Teaching Digital Safety to Students

Cyber hygiene for schools is more important than ever in today’s digital learning environment. Teaching digital safety to students not only protects their personal information but also strengthens overall school cybersecurity. With increasing online access in classrooms, cyber hygiene for schools must become a routine part of curriculum planning and student behavior expectations.

Mental Health Benefits Go Mainstream: What Employers Need to Know

Once considered a niche offering or a reactive add-on, mental health benefits have now moved to the center of the employee experience. In 2025, nearly half of U.S. employers offer some form of mental health support beyond traditional EAPs—a sharp rise from just 30% in 2023. This shift isn’t just cultural; it’s strategic.