The number of older Americans is steadily increasing. According to the U.S. Census Bureau, in 2019, the population of people aged 65 and older numbered 54.1 million. It is projected to grow to over 80 million by 2040.

With an aging population comes an increased need for long- and short-term senior care. The demand for more care will increase the burden on nursing facilities and potentially expose an already high-risk industry to even more loss. Review the following for a look at the types of losses that occur most frequently at senior care facilities, according to Advisen’s database, and how to mitigate them.

Background

Senior care facilities include any organization that is primarily focused on providing inpatient nursing and rehabilitative services. Here are some examples of establishments in the senior care industry:

- Inpatient rehabilitation facilities

- Nursing homes

- Assisted living facilities with senior care

- Rest homes with senior care

- Inpatient care hospices

Care is typically provided over an extended period of time by registered or licensed practical nurses and other staff.

Medical Malpractice Risks

Senior care facilities typically receive funding from Medicare, Medicaid and some insurance programs, which operate on tight margins. As a result, senior care facilities often struggle to balance the need for quality care with financial health. The following are ways in which understaffing, inadequate training and other cost-cutting measures can contribute to risk:

- Medical errors—Medical errors include the failure to diagnose and the improper diagnosis of residents. They can also include errors associated with giving too much or too little medicine, applying incorrect administration techniques, giving expired medications, failing to monitor a resident after administering medicine and having lab inaccuracies. These errors can lead to serious injury or death.

- Negligence—Common issues associated with nursing home negligence include inadequate nutrition and failures to provide medical attention, assist with bathroom necessities, ensure proper shelter and maintain a safe environment. Neglect may result in bedsores, dehydration, weight loss, depression, sepsis or severe infection, and even death.

- Slips, trips and falls—Senior citizens are especially prone to fall risks. According to the Centers for Disease Control and Prevention, 1,800 nursing home residents die every year due to slips, trips and falls. Nearly one-quarter of these falls result from muscle weakness or walking problems. However, an additional 16% to 27% of slips, trips and falls are caused by environmental hazards, including wet floors, poor lighting, incorrect bed height and poorly maintained wheelchairs.

- Abuse—Elder abuse is unfortunately common. According to the World Health Organization, 64% of staff at nursing homes or long-term care facilities have admitted to committing abuse in the past year. Staff burnout, understaffing and undertraining are factors that contribute to abuse risks. Elder abuse can cause serious injury or death. It may also result in lawsuits.

- Vehicle accidents—Nursing homes and elder care facilities frequently offer transportation for off-premises outings (e.g., movies, salons, restaurants). Inadequate staff training or improper use of safety equipment may result in accidents or harm.

- Employment practices liability (EPL)—Discrimination and sexual harassment are a high risk for senior care staff because they are frequently in close or physical contact with residents and family members. Other potential EPL claims include allegations of wrongful termination and retaliation.

- Directors and officers—The directors and officers of a nursing home may face legal ramifications if they are perceived as having acted without proper care and due diligence. Allegations may include fraudulent practices, conflict of interest, improper self-dealing and mistakes or errors in judgment.

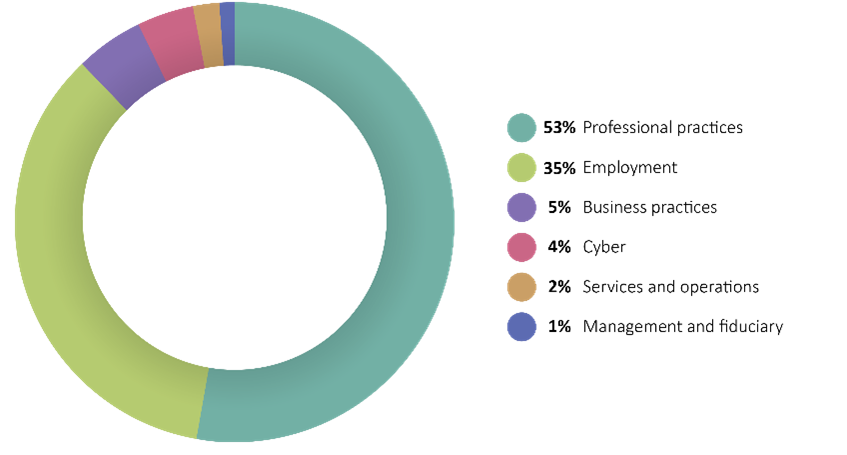

Senior Care Losses By Category

Professional practices account for the majority of nursing home losses at 53%. These losses primarily consist of abuse, negligence and medical malpractice allegations and fraudulent claims filed with the Centers for Medicare and Medicaid Services

Wage and hour is the dominant type of employment loss at senior care facilities. The prevalence of these losses reflects the tight margin the industry operates under, contributing to the temptation to cut corners and costs. Claims of discrimination and harassment account for 16% of the remaining employment losses. Allegations of racial discrimination, discrimination and harassment prohibited under the Americans with Disabilities Act, wrongful termination, gender and sexual discrimination, and sexual harassment were the most prevalent in this industry.

Business practices risks account for 5% of losses at senior care facilities. These losses typically fall under the False Claims Act. Violations of the False Claims Act occur when a person knowingly submits false claims to the government. A heavy reliance on Medicare and Medicaid funding at senior care facilities puts them at increased risk for this type of fraud.

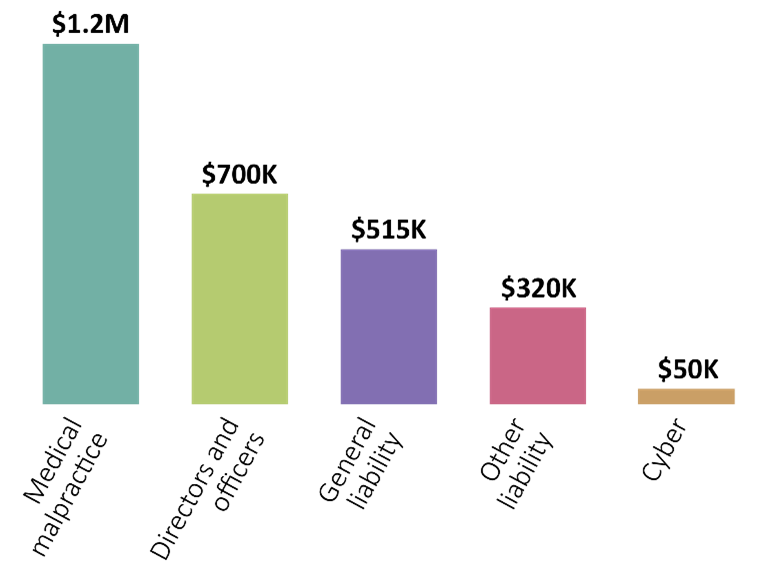

Senior Care Losses by Median Survey

Medical malpractice accounts for the highest median severity of senior care losses at $1.2 million. Directors’ and officers’ liability and general liability had the second and third-highest median severity. It’s important to note that Advisen data focuses primarily on large and significant losses. Therefore, these losses may not be fully representative of all losses of this type.

Significant losses in Advisen’s database include:

- In 2013, a jury handed down a $1.1 billion verdict against Trans Healthcare Inc. and Trans Healthcare Management for extreme negligence and abuse of a resident, leading to bedsores, dehydration, malnutrition, intentional overmedication and closed head trauma from a fall. The resident died shortly after being removed from the facility.

- In 2010, a jury returned a $677 million verdict against Skilled Healthcare Group Inc. for allegations of numerous state violations related to inadequate staffing, resulting in negligent resident treatment. The verdict was the result of a class-action lawsuit from 32,000 residents.

- In 2016, a jury returned an $80 million verdict against the owners of Global Healthcare Inc. for Medicaid fraud and money laundering in association with their business as personal care aides for the elderly.

Risk Management

Proper risk management is necessary for resident safety and to reduce medical malpractice losses. Here are some risk management strategies to consider:

- Adopt medication management systems. Create a medication cross-checking program or a medication management system for verifying resident medication. This will help prevent medication errors.

- Prevent slips, trips and falls. Evaluate resident rooms and common areas for slip and fall risks. Pay special attention to any areas where there are loose carpeting, cables or stray equipment, and moisture.

- Train staff. Staff should receive regular safety training that includes risk mitigation and resident handling and safety techniques. During training, staff should also be told how to recognize signs of abuse.

- Obtain insurance. Proper insurance coverage can help mitigate the risk of costly losses. General liability insurance, professional liability insurance, sexual misconduct coverage and commercial property insurance are among the lines of coverage that should be considered.

Mistakes and inappropriate conduct in nursing homes may not only lead to lawsuits but may also cause serious injury or even death. For more ways to mitigate medical malpractice, contact us today.

This is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. © 2023 Zywave, Inc. All rights reserved.

About the Author

Share This Story

Related Blogs

AI Powered Benefits Solutions: Navigating Rising Costs in 2026

Health benefit costs are projected to rise nearly 9% in 2026, putting significant pressure on employers to balance affordability with employee satisfaction. Against this backdrop, artificial intelligence (AI) is emerging as a transformative tool in the benefits space.

Understanding Home Renovation Risks

Whether you’re building a new home addition, adding a feature like a swimming pool, redoing a bathroom or upgrading an electrical system, understanding and addressing possible renovation risks is critical.

Understanding Your School Property Schedule

Your property schedule is one of the most important—and often overlooked—documents in your insurance program. While it may look like a simple list of buildings, values, and locations, this schedule plays a critical role in how your coverage responds when a loss occurs.