Misprint? Typo? No.

In most purchasing scenarios across America, a favorable rate typically means a favorable price. Consider these everyday examples:

- A 3.5% interest rate on a mortgage results in lower payments compared to a 4.5% rate.

- Lower rates on general liability, auto, or home insurance equate to lower annual premiums.

- Businesses pay less for goods or materials at a “low” rate rather than a “high” rate.

- Gasoline priced at a rate of $2.45 per gallon costs less than when it exceeds $2.45 per gallon.

Business owners and CFOs often use “rate” and “price” (annual premium) interchangeably. However, this logic doesn’t apply to Workers’ Compensation. Contrary to what many brokers and agents believe, and what the insurance industry often falsely promotes, the pricing components for Workers’ Compensation premiums don’t follow the general rule that lower rates equal lower prices.

In Workers’ Comp, lower rates do not necessarily mean lower prices because the calculation involves more than just a rate; it includes a “multiplier” called an E-mod score.

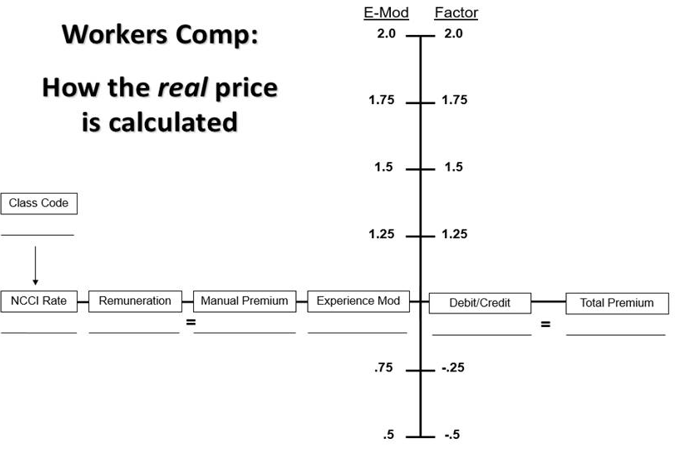

The detailed mechanisms are explained in a 43-page manual dissecting the NCCI (National Council on Compensation Insurance) E-Mod promulgation. To simplify, here’s how Work Comp annual premiums are calculated:

- Each worker is assigned a class code by the NCCI based on their duties, with over 1,000 class codes available.

- Each class code has a rate, which is the amount per $100 of payroll that contributes to a workers’ comp premium. This rate is set by the NCCI annually and must be used by all work comp carriers, agents, and payroll services.

- The total payroll for each class code is multiplied by the rate to get the “Manual Premium,” which would be the actual premium if there were no E-Mod score. However, no qualifying company pays based solely on their manual premium.

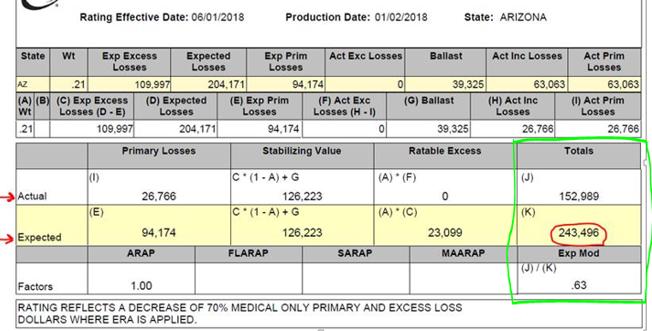

- The E-Mod score acts as a multiplier, calculated as the Actual Losses divided by the NCCI “Expected Losses” (see Exhibit MYEMGA – 1).

- The annual Work Comp premium is the “manual premium” (class code rate X payroll) multiplied by the E-mod score.

- When the NCCI lowers workers’ compensation rates, it directly and proportionally decreases the ‘Expected Losses Row,’ which is the Denominator in the EMOD equation (as shown in Exhibit MYEMGA – 1, where it is 243,496).

- When the denominator decreases and the numerator (152,989) remains the same (since it represents ‘actual losses’ that have occurred), the result is a higher EMOD to balance out the lower manual premium produced by the lower rates.”

Therefore, the article’s title: Workers’ Compensation rates continue to fall, and yet workers’ comp premiums stay the same.

Exhibit MYEMGA – 1

Exhibit MYEMGA – 2

The calculation of annual WC premiums can be illustrated with a simple multiplication example:

Exhibit MYEMGA – 3

A) 7 x 10 x 3 x 4 = 840

B) 10 x 3 x 4 x 7 = 840

Regardless of how you arrange the numbers, the product remains 840 every time. Workers’ Comp premium calculations work similarly; rearranging or shifting the numbers doesn’t change the sum product.

In the initial examples (mortgage, insurance, materials, and gasoline), note that an E-Mod score isn’t applied as a multiplier. Workers’ Compensation is unique in using an E-Mod score as a multiplier, making it crucial to understand the multiple factors involved in calculating Workers’ Compensation annual premiums.

Contrary to popular belief in the insurance industry, the EMOD score is what truly determines a company’s workers’ comp premium.

Unfortunately, despite its significance, the Experience Modification Rate (EMOD) is often overlooked in the insurance industry. Many brokers, agents, and even underwriters lack understanding of what an EMOD is, its purpose, or its substantial impact on a business’s insurance costs. This oversight leads to companies missing out on significant workers’ comp savings.

In Workers’ Compensation, the reality is that the E-Mod score determines the majority of the annual premium, rather than the non-disputable rates assigned by the NCCI for each class code. Which is to the benefit of savvy companies that understand how the EMOD score works and know how to control it.

“Lower rates should equal a lower premium, right?”

For further construction and risk management resources, contact INSURICA today.

This is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice.

About the Author

Share This Story

Related Blogs

Commercial General Liability Insurance

Running a business comes with significant risk. Everyday interactions, such as serving customers, visiting clients or running marketing campaigns, can expose businesses to potential liability. A customer could slip on a wet floor, a contractor could accidentally damage a client’s property, or a marketing campaign could unintentionally harm the reputation of a competitor. Just one single liability incident can trigger an expensive lawsuit and have far-reaching consequences. Beyond potential settlement costs, legal defense costs—even if claims are found to be baseless—can quickly escalate into tens or hundreds of thousands of dollars. Furthermore, litigation can disrupt operations and undermine customer and stakeholder trust.

Mounting and Dismounting Forklifts

Forklifts play an important role in moving materials safely and efficiently in many workplaces. However, even a simple task like getting on or off a forklift can lead to serious injuries if not done correctly.

Employee Benefits Compliance Updates for 2026

As 2025 closes, several pressing compliance issues will shape your responsibilities in 2026. Updated PCORI fees, Affordable Care Act (ACA) reporting obligations, state-level mandates, and new federal requirements such as gag clause attestations are all on the horizon.