Managing Risk Around School Construction & Renovation Projects

School construction and renovation projects are essential for maintaining safe, functional, and modern learning environments. Whether a district is expanding due to enrollment growth, upgrading aging facilities, or making safety improvements, construction activity introduces a level of risk that goes well beyond the worksite itself. When projects occur on active campuses, those risks extend to students, staff, contractors, and district operations.

Health & Welfare Benefits Year End Roundup: 2025 Regulatory Highlights

As 2025 draws to a close, employers and benefits professionals face a shifting regulatory landscape that will shape health and welfare programs in 2026 and beyond. This year’s developments underscore the government’s dual priorities: expanding access, modernizing benefit delivery, and balancing compliance with practical flexibility. Below is a roundup of the most significant regulatory highlights.

Winter Weather Preparedness: Keeping School Operations Safe and Moving

Winter weather events are becoming less predictable, even in regions that don’t traditionally experience prolonged cold, ice, or snow. Sudden freezes, icy roadways, power disruptions, and rapidly changing forecasts can create significant challenges for school districts — often with little time to respond.

Supporting Employee Mental Health During Challenging or Traumatic Times

During challenging times or traumatic events, organizations can do a lot to support employees. NAMI encourages people to bring their whole selves to work, which includes their mental health. As employers, it’s important to acknowledge what’s happening outside of the workplace, its potential impact on employee wellness, and support employees so that they can continue to do their best work.

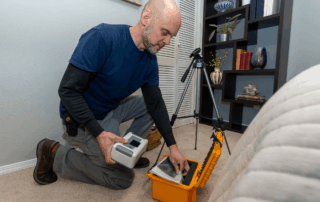

Eliminate Radon Dangers

Radon is a naturally occurring radioactive gas produced by the breakdown of uranium in soil, rocks and water. Since the air pressure in a typical home is lower than the pressure in the soil around the foundation, the home acts like a vacuum and draws radon in through cracks in the foundation.

Snowmelt Prevention Tips

As winter ends and temperatures begin to rise, the accumulating water from melting snow and ice—also known as snowmelt—can lead to significant property damage. Don’t let snowmelt wreak havoc on your home. Review the following guidance for snowmelt prevention recommendations.