Many have been there staring at a workers’ compensation insurance proposal, overwhelmed by a premium so steep it feels like a punishment. The explanation seems simple: one big, catastrophic claim has thrown your experience modification factor (EMOD) into chaos, leaving you with an astronomical bill.

But here’s the thing—this explanation isn’t just oversimplified; it’s wrong. In reality, a single claim almost never causes the kind of spike that sends premiums into orbit. The real story lies in the math, and understanding it can save your business from falling into a costly trap.

The Math

Contrary to popular belief, the EMOD system is designed to avoid catastrophic fluctuations caused by isolated incidents. Here are the three key factors that ensure stability:

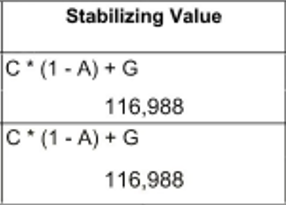

- The Stabilizing Value: The stabilizing value is a numeric value found on the bottom part of an EMOD calculation. Aptly named, it acts as a ballast. It remains the same on both the numerator and denominator sides of the equation. Its purpose is to keep things in check and prevent singular claims from massively fluctuating or influencing an EMOD on their own. It also ensures that any given company has an EMOD, even if there are no claims.

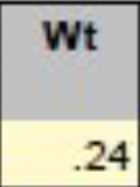

- The W Factor (Weighting Factor): This is an extra discount given to claims that exceed the split point for any singular claim and become an excess claim. The W factor is a significant discount that typically ranges from 95% to 60%, depending on the size of the company. It is used to significantly reduce the impact a massive claim has on any given business.

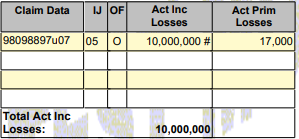

- Total Claim Cap: The total claim cap serves as the maximum amount of claim dollars that will impact an EMOD score. This varies by state and is updated yearly, but its function never changes. Once this limit is reached, a pound sign will appear next to the total dollar amount. This indicates that this claim has reached its max, meaning that only the money up to the cap limit will affect the EMOD score. So how about a claim that is $500,000, $1,000,000, or $10,000,000? It doesn’t make a difference; only the amount up to the cap amount will count in the EMOD calculation.

This framework, established by the National Council on Compensation Insurance (NCCI), ensures that even large, rare claims have a limited effect on your EMOD. As the NCCI states, “One very large loss does not imply a pattern of claim frequency.”

The real driver of high EMOD scores isn’t the one-in-a-million claim—it’s the small, frequent, and often overlooked claims. These recurring incidents, when mismanaged, add up over time and weigh heavily on the EMOD calculation. A single catastrophic claim is less predictive of future risk than a pattern of frequent, smaller claims. It’s these smaller claims that demonstrate a lack of effective risk management and drive premiums higher.

In rare cases, a single claim can cause a significant EMOD hike—but only for small businesses with minimal expected losses. For example, an accounting firm with a modest workers’ comp policy might see its EMOD spike following a severe car accident involving its employees. Even then, the actual premium increase would be marginal for a company that has a small premium base to begin with.

While it may be tempting to attribute an elevated EMOD to a single claim, this is rarely the case. It’s a simplistic and convenient way to sidestep the more complex reality: high EMODs typically result from numerous mismanaged small losses. This shifts the responsibility for EMOD control back to the company and the broker. The key to maintaining a low EMOD lies in effectively managing small and frequent claims, rather than merely hoping that a major claim won’t impact you. The most concerning claims usually aren’t the memorable ones but those that slip under the radar—unnoticed and unattended—leading to persistently high EMODs. These overlooked claims are where the real negative shifts occur, but they also present significant opportunities. By addressing these claims, a company can take control of their EMOD and, consequently, the premiums they pay.

Next time someone tells you, “It’s all because of that one bad claim,” you can confidently respond: “It’s not that simple.” The truth lies in the math, and the math doesn’t lie. Managing your EMOD means managing the small, frequent claims that fly under the radar—not fearing the occasional big one.

The power to lower your workers’ comp premium isn’t in avoiding bad luck—it’s in making smarter choices. And that’s not just math; that’s empowerment.

For further construction and risk management resources, contact INSURICA today.

This is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice.

About the Author

Share This Story

Related Blogs

Insurers Turn to Telematics to Address Rising Commercial Auto Losses

Amid a steep rise in accident severity and litigation costs, commercial auto insurers are turning to telematics technology to improve risk assessment and help stabilize a market under financial strain.

Marketplace Coverage and Employer Plans: What Employers Need to Know

As Marketplace health plan premiums rise and subsidies shift, employers are seeing more requests from employees (and their spouses) to drop Marketplace coverage and enroll in an employer-sponsored health plan mid-year. While this may feel straightforward, Marketplace rules and employer plan rules do not always work the same way.

AI Powered Benefits Solutions: Navigating Rising Costs in 2026

Health benefit costs are projected to rise nearly 9% in 2026, putting significant pressure on employers to balance affordability with employee satisfaction. Against this backdrop, artificial intelligence (AI) is emerging as a transformative tool in the benefits space.