FEMA Flood Risk Rating Changes

Atlantic hurricane season is underway, but it doesn’t take a hurricane to cause a flood event. Flooding tops the list as the most common natural disaster in the United States and can happen anywhere. The aftermath of a flood event can be devastating emotionally and financially. The Federal Emergency Management Agency (FEMA) says just one inch of water in a structure can cause up to $25,000 of damage.

Even if your home or business isn’t near a flood zone, securing an adequate flood insurance policy could be a lifesaver when dealing with a natural disaster. FEMA is launching a program this fall that could change how homeowners pay for their flood insurance policies.

FEMA will roll out a new rating system for the National Flood Insurance Program (NFIP), Risk Rating 2.0.

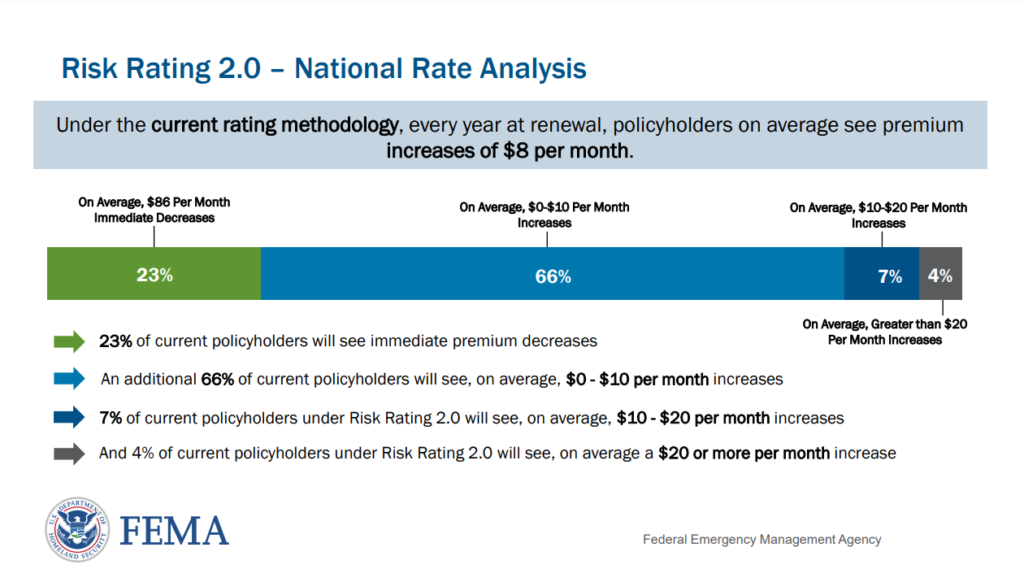

According to FEMA, Risk Rating 2.0 allows the agency to better inform individuals and communities about flood risk, set premiums to signal those risks, and promote actions to mitigate against them. Individuals will no longer pay more than their fair share in flood insurance premiums.

Here’s what you need to know about Risk Rating 2.0:

- In Phase I: New policies beginning Oct. 1, 2021, will be subject to the Risk Rating 2.0 rating method. Also, beginning Oct. 1, existing policyholders eligible for renewal will take advantage of immediate decreases in their premiums.

- In Phase II: All policies renewing on or after April 1, 2022, will be subject to the Risk Rating 2.0 rating method.

Conclusion

The NFIP’s current rating methodology has not changed since the 1970s and does not consider individual flood risk and underlying home values. Risk Rating 2.0 will change the way FEMA views flood risk and prices flood insurance.

FEMA continues to engage with Congress, its industry partners and state, local, tribal and territorial agencies to ensure clear understanding of these changes.

It’s critical to work with industry experts who have the necessary knowledge and experience.

Contact a team member near you at INSURICA.com/our-team to learn more about flood insurance or assist you with your current policy.

About the Author

Share This Story

Related Blogs

Insurers Turn to Telematics to Address Rising Commercial Auto Losses

Amid a steep rise in accident severity and litigation costs, commercial auto insurers are turning to telematics technology to improve risk assessment and help stabilize a market under financial strain.

Marketplace Coverage and Employer Plans: What Employers Need to Know

As Marketplace health plan premiums rise and subsidies shift, employers are seeing more requests from employees (and their spouses) to drop Marketplace coverage and enroll in an employer-sponsored health plan mid-year. While this may feel straightforward, Marketplace rules and employer plan rules do not always work the same way.

AI Powered Benefits Solutions: Navigating Rising Costs in 2026

Health benefit costs are projected to rise nearly 9% in 2026, putting significant pressure on employers to balance affordability with employee satisfaction. Against this backdrop, artificial intelligence (AI) is emerging as a transformative tool in the benefits space.