We specialize in you – so you can specialize in what you do best.

Today’s insurance programs must take into account the unique challenges faced by each client. In addition to a strong coverage program, some businesses may need advanced services. INSURICA has the additional Client Services required by complex business operations including alternative risk, claims management, and loss control.

Our Approach

At INSURICA, it’s not about selling an individual policy, but rather understanding your entire business structure and developing a comprehensive insurance management program just for you. By placing a priority on identifying the unique risks and challenges you face, we’re able to uncover solutions that lead to greater opportunities and savings.

Our Industries and Insurance Solutions

INSURICA is made up of insurance and risk experts who specialize in their core disciplines. Whether you need a solution for your business, employees, or home office, our expertise allows us to uncover often-overlooked risks and opportunities, crafting a solution just for you.

Agriculture

Too much rain, too little rain, too hot, too cold, increasing costs, federal regulations, mandates, liabilities, welcome to the world of agriculture.

Construction

Our rock-solid reputation in construction insurance is recognized throughout the industry. We’re also expert surety partners, allowing you to capitalize on every growth opportunity.

Education

INSURICA’s Education Experts bring the experience, guidance and resources you need to uncover and manage unforeseen risks on and off campus.

Energy

Our comprehensive approach to insurance and risk management begins by analyzing energy-focused business operations from the ground up.

Environmental

INSURICA Environmental Experts are here to help you manage and mitigate environmental risk.

Financial

Our Financial Service Experts are here to help you identify, manage and avoid costly exposures – promoting growth during these uncertain financial times.

Healthcare

Our dedicated team brings years of practical experience and cost-saving insight to nearly every area of the healthcare industry.

Hospitality

Our Hospitality Experts will create a comprehensive program designed to lower risk, minimize insurance claims and positively impact your bottom line.

Manufacturing

Our customized programs are tailored to the assets, earnings and liabilities of manufacturing businesses.

Ministries

Our Ministries Practice was created to assist churches, non-profit organizations and para-church ministries with risk management and insurance solutions.

Not-for-Profit

INSURICA’s Not-For-Profit Experts will help guide, assess and craft coverage plans to meet your specific organization’s needs.

Oklahoma Energy Insurance

Our comprehensive approach to insurance and risk management begins by analyzing energy-focused business operations from the ground up.

Staffing

Our Staffing Experts manage risk and develop products and services to specifically address staffing exposures.

Technology

Our Technology Experts create customized and comprehensive coverage plans to keep your company on the technology fast track.

Transportation

Our Transportation Experts begin by fully understanding and analyzing your operations, driver processes and regulatory compliance procedures.

Alternative Risk

Tailored insurance programs to meet your specific needs.

Background Screening

When background screening is an integral part of an overall risk management and loss control program, employers are able to achieve the peace of mind they need.

Captives

We provide consulting and operational management services to our clients through an integrated network of captive experts.

Claims Management

Simply stated, it’s the transactional handling of a company’s insurance claims. At INSURICA, we define claims management a little differently.

Client Services

Whether you’re looking for claims management, loss control or alternative risk programs, INSURICA’s industry specialists have a program to meet your business needs.

Commercial Insurance

INSURICA is made up of insurance and risk experts who specialize in core industries such as yours.

Cyber

At INSURICA, we want to help you protect your business by understanding your goals, providing resources, and offering expert advice and analysis.

Employee Benefits

Our Employee Benefits Experts can help you develop and implement a benefits program designed to motivate your employees while minimizing your cost.

Global Reach

In addition to INSURICA’s own extensive network of experts, we are able to leverage the expertise of other insurance leaders throughout the US and the world through our partnership with Assurex Global.

Individual & Family Health Insurance

Broker Source, a division of INSURICA provides best in class health insurance services to individuals, families, and small groups in Kansas City and the surrounding areas. Our seasoned colleagues and business professionals have unmatched experience and expertise giving them an in-depth understanding of their clients needs.

INSURICA Direct

INSURICA Direct, an exclusive program developed for the small business owner.

INSURICA Express Referral Form

INSURICA Express, an exclusive program developed for the small business owner.

INSURICA Express Referral Form

INSURICA Express, an exclusive program developed for the small business owner.

Loss Control

Comprehensive programs to reduce risk and minimize loss.

Personal Insurance

By managing your complete risk and exposure needs, we help you “see it all” so you can make an informed decision and plan accordingly.

Surety and Bonds

Providing you with insight and strategies that not only protect your company, but can help maximize surety credit and therefore business potential.

Tell Us

INSURICA Borrower Info

Tribal

The INSURICA Tribal Practice is built upon a foundation of understanding the needs of Native America.

Workers’ Compensation

INSURICA is made up of insurance and risk experts who specialize in core industries such as yours.

Risk Management

Our in-depth understanding of your business allows us to uncover often-unseen risks and opportunities that can dramatically lower your exposure and costs.

By working directly with your management team, we’ll help you determine which risks should be managed internally by minimizing or eliminating exposures, and which risks warrant the direct involvement of an insurance company.

Insurance for the Construction Industry

Our extensive experience in virtually every segment of the construction industry gives us a holistic view and in-depth understanding of general contractors, general engineering contractors, and specialty trade contractors. We’re also expert surety partners, allowing you to capitalize on every growth opportunity.

We Are Here to Serve You

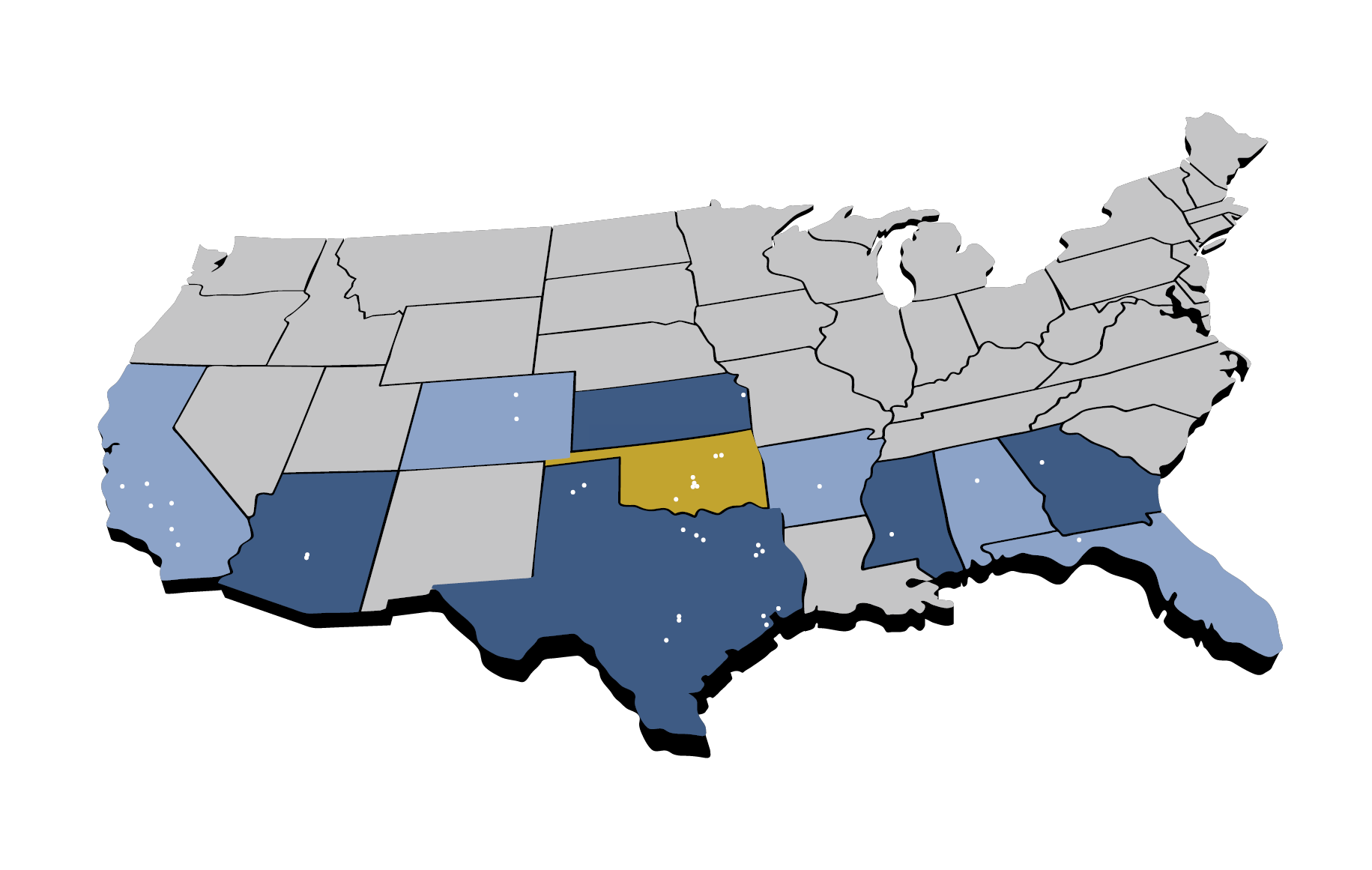

With more than 35 locations throughout the U.S., a specialized insurance program is never too far away.

Latest News

Today’s insurance programs must take into account the unique challenges faced by each client. In addition to a strong coverage program, some businesses may need advanced services. INSURICA has the additional Client Services required by complex business operations.

Mitigating Mold and Moisture Risks in Schools

Mitigating mold and moisture risks is essential for ensuring a safe and healthy learning environment in school facilities. Excess moisture from leaks, high humidity, or poor ventilation creates ideal conditions for mold growth, which can compromise air quality and pose health risks like respiratory issues and allergies, potentially leading to increased absenteeism and liability concerns. Proactive strategies to address these risks help schools maintain safe, operational facilities. Here are five key prevention strategies to consider: Conduct Regular Inspections Roof [...]

New Rules Could Transform Instant Pay Benefits

Federal regulators are moving to classify earned wage access programs as consumer loans, signaling a major shift for this rapidly growing employee benefit. The Consumer Financial Protection Bureau's proposed rule could reshape how companies like Walmart, Bath & Body Works and McDonald's offer early access to earned wages.

58% of Millennials Bet on 401(k)s Over Social Security

A significant generational shift in retirement planning is reshaping how employers need to think about their benefits packages. While older generations have traditionally viewed Social Security as their primary source of retirement income, younger workers are increasingly putting their faith—and their money—into personal retirement accounts.